Credit scores are an important part of life for many people as they affect individuals’ ability to apply for loans. They can also be used by employers, utility companies and landlords to assess the suitability of potential employees and customers. These scores, however, have been notoriously opaque and hard to access, as they have been controlled by a few large companies.

In 2017, all three major credit rating agencies in the US – Experian, Equifax and TransUnion – were fined for misleading consumers, highlighting how little control consumers have had over this data. Now, new start-ups are emerging to help demystify credit scores, by providing free access to credit scores and reports; clarifying how they’re calculated; and giving advice on how to improve them. Here are six companies we’ve spotted who are demystifying credit scores:

1. ClearScore

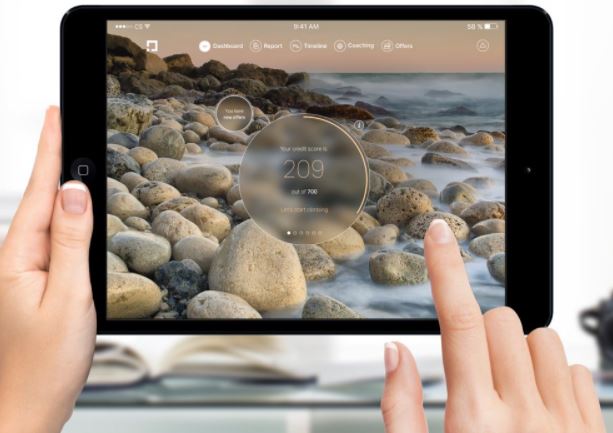

ClearScore provides ongoing free access to credit scores and credit reports. It aims to make credit scores more transparent, and help users increase their financial wellbeing. A financial dashboard is updated monthly, regular checks will not affect user’s scores, and advice on how to improve a credit score is available. Products including credit cards and loans can be purchased via the company, which receives commission on sales.

2. Noddle

Offering a free credit report for life, Noddle aims to help users take control of their finances. The report includes credit history, information about how well borrowed money has been managed, and a list of recent searches made on the credit file. Again, the company receives commission from any product sold via the site.

3. CreditWise

3. CreditWise

Run by Capital One, CreditWise gives quick, free access to the Equifax credit score. CreditWise claims that checking a score through its service will not impact the credit score, and the Simulator function allows users to explore the potential impact of a decision before making it.

4. Aire

In July 2017 credit scoring start-up Aire completed a Series A funding round. Aire uses AI to help those with little traditional credit history (for example, first-time borrowers) gain access to credit. Applicants carry out an Interactive Virtual Interview, where their profession, lifestyle and financial maturity are evaluated, and their creditworthiness determined.

5. CreditHero

Launched in May 2017, CreditHero aims to increase understanding of credit scores and help consumers improve them. Using a bot, CreditHero provides recommendations to help users boost their credit score and achieve their financial goals.

6. JuanCredit

Ayannah launched JuanCredit in Spring 2017, a credit scoring system powered by AI. Currently available in the Philippines, JuanCredit analyses data from sources such as utility bills, mobile top-ups and social media to provide credit scores for the unbanked.

Consumers’ awareness of their credit score, and how to improve it, will increase as freely accessible services become more widely recognised and used. This is likely to increase the number of consumers eligible for loans and financial products, widening the potential customer base for many traditional financial institutions.

Alternative methods of determining creditworthiness using newly available data such as social media profiles provides an extra route to verification. Combining these data streams with traditional aspects can enhance companies’ abilities to assess credit risk.

Looking for more fintech content? Check out this post on the latest in biometric finance.

Lead image: “Good Credit Score” by Cafe Credit, is licensed under CC BY 2.0